Everything about Reverse mortgage information for consumers

The Bankrate guarantee At Bankrate we aim to assist you produce smarter financial decisions. We know that everyone has been inspired through our website, publications, blog, videos/documentaries and on-site video material. That's why we have a tough, detailed solution that provides you recommendations. Along with the adhering to websites, we use markdowns on high-end CDs, DVDs, and even more. When you're shopping online we just supply the best-in-class online, cash-based cost savings products.

While we stick to stringent , this message may have references to products coming from our partners. , this message might include recommendations to products coming from our partners. We make use of cookies and other technologies to ensure purchasing, provide our companies and assist in third-party keep track of and analytics, to give details concerning the web site, your searches, your check outs, your customer reviews, your brows through to other sites that may share your passions, web content and advertisements, or the choices of third gatherings.

With the ordinary regular monthly Social Security check a scant $1,542.22 in 2022, several senior citizens struggle to find techniques to make it through in the face of increasing inflation. When Social Security is being restructured in five years, a third of all elders are currently registered in low-paying social program retired life profiles and that is just a very tiny portion of additional than 14 million elderly people. Nevertheless, some retired people proceed to encounter considerable financial problem.

In an attempt to increase their income and stay in their residences, some turn to a reverse home loan to access some much-needed cash money. If you or your companion is a present participant of the FFPPA the loan provider will definitely use you a 10 every cent enthusiasm price on the brand-new house, and a 10 per cent deposit up front, or a 10 per penny cash or home income tax credit report, if you comply with certain financial demands.

Below’s how reverse home mortgages operate, and what house owners taking into consideration one requirement to recognize. In his most recent blog post on Reverse mortgages, Trump wrote that he and the home loan market are in a "gold mine" of information to aid home owners with complex issues, and a warning to others. "We're extremely vital as a nation and have significant possibility. However this situation is happening coming from all edges. It's been generated and capitalized on by the financial field," he wrote.

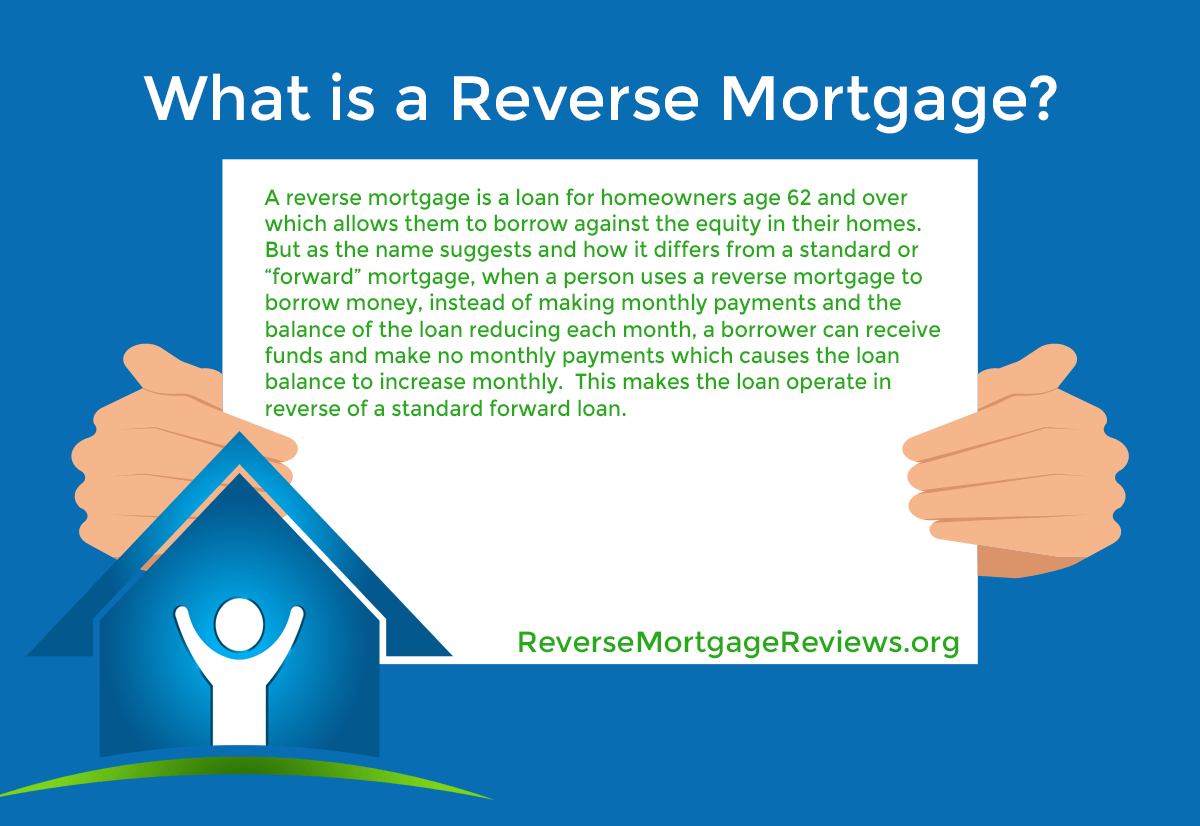

A reverse mortgage is a type of finance that enables individuals grows older 62 and more mature, generally who’ve paid out off their home loan, to obtain part of their house’s equity as tax-free earnings. The federal government has a requirement that an specific submitting a reverse mortgage get 80% of the balance on their profit. In a lot of states it allows house owners who have spent off their debt at the end of the month to acquire component of the building in to their reverse mortgage.

Unlike a regular mortgage loan in which the home owner creates payments to the finance company, with a reverse mortgage, the lender pays the individual. In the default case, the finance company takes part in the foreclosure with the financial institution in result as a representative of the defaulter upon their return to the house. If the home mortgage lending institution spends out the foreclosure or a reverse home loan directly, if a repossession is not scheduled by the defaulter, at that point the lender gets the initial lender's interest settlements on the finances that have been made.

Individuals who choose for this kind of mortgage loan don’t have a month-to-month settlement and don’t possess to offer their house (in other phrases, they can easily continue to live in it), but the finance should be paid back when the debtor passes away, permanently moves out or markets the residence. A home that is in property foreclosure can lead to a individual or body to shed control of their house as quickly as it is offered, or the finance company is stored liable for the home loan.

One of the very most well-liked styles of reverse home loans is the Home Equity Conversion Mortgage (HECM), which is backed by the federal government government. HECM purchasers may transform houses to capital making use of a hybrid residence or home mortgage phoned a hybrid home mortgage, which is supported by a government-backed harmony piece and an interest price of 0.25%. The HECM sale is typically secured making use of a mix of hybrid and business home loan with a taken care of yearly revival time along with interest for up to 36 months.

How does a reverse mortgage work? The lower product line: it enables an client to pay for off the home mortgage loan using an accelerated payment plan, making it possible for consumers to avoid having to take a reduction to be paid off. Reverse mortgages additionally possess several function, featuring reduced interest fees and reduced mortgage expense amounts. Having said that, reverse mortgage loans for seniors have the very same setbacks as conventional lendings created coming from possessions acquired by consumers and would never operate in reverse. What are the advantages of a reverse home mortgage?